Guide for investors on unit trust sales practices – Excerpt from The Reporter by Securities Commission Malaysia

While stories of cheating abound in social media, protecting yourself from scams and fraudsters is easier than you think.

While stories of cheating abound in social media, protecting yourself from scams and fraudsters is easier than you think. For a start, if you want to invest in unit trusts, make sure you deal with an authorised person. Check with the Federation of Investment Managers (FIMM) to confirm his status as a unit trust consultant. Regulatory authorities such as Securities Commission Malaysia (SC) and Bank Negara Malaysia also provide investor alerts on dubious or illegal schemes on their websites.

The unit trust industry in Malaysia is a regulated industry, with both SC providing layers of protection for investors through laws, licencing and enforcement, and FIMM ensuring that unit trust distributors and consultants adhere to rules and code of ethics. Both carry out investor education efforts online and off-line.

However, investors also have to fulfil their own responsibilities. We have seen investment disputes happen because of misunderstanding during the sales process. Sometimes, investors are given incomplete information about the product. Sometimes, investors put in their money without knowing the extent of fees and sales charges. There may also be fraud but these may be avoided if investors know what to look out for. An investor should also truthfully disclose his own financial situation when seeking advice on investments. Otherwise, the advice he receives will be based on an inaccurate risk profile, and he could find that he had invested in an unsuitable product.

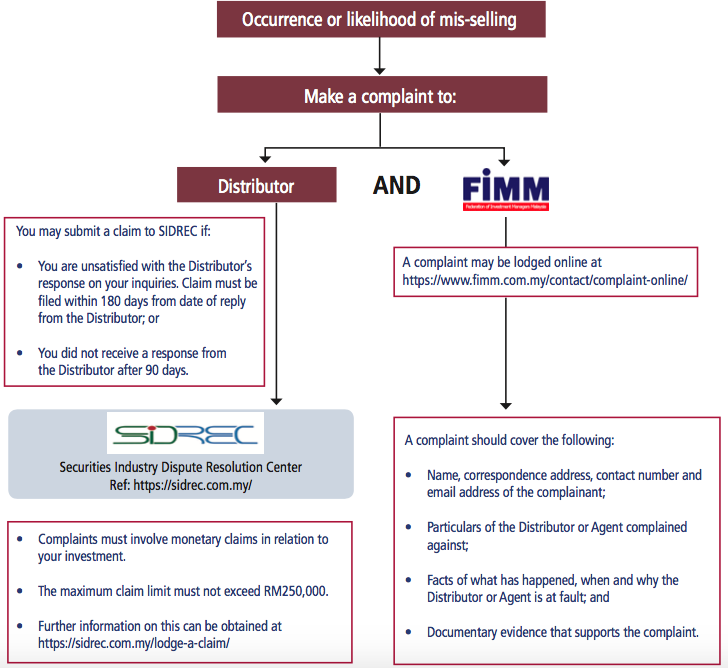

Investor should also ensure they know where to seek help should they have a complaint on how their investment has been handled. The SC has provided an independent expert avenue to help settle investment disputes between investors and market intermediaries, through SIDREC, to give investors and additional avenue to seek help should they need it. Visit www.sidrec.com.my to find out more.

SC has produced an article entitled Sales Practices: Building trust and confidence in the unit trust industry in The Reporter. Below is an excerpt for investors who are considering investment in unit trusts and what you can do should mis-selling happen. You can read the full issue of The Reporter here.

You have rights and can influence sales ethics. Understand the product and be satisfied that it suits your investment needs before parting with your hard earned money, just like how you would before purchasing a house or car. You have to take effort to safeguard your own interests, even if the Agent is a friend or relative.

Note: Always ask for official receipt for all payments made that the Distributor is obliged to issue. If any detail or information in the receipt is inaccurate, please check with the Distributor directly.

If any of these red flags appear, contact SC, FIMM or the Distributor whom your Agent is attached to immediately.

Whether you are a first-time investor or have been investing for many years, there are some basic questions you should always ask before you commit your hard-earned money to an investment.

• How much returns do I need?

• When do I need the returns?

This will help you decide if you need a short, medium or long-term unit trust fund.

• How much monies can I set aside for the investment?

You must make sure you have funds for daily needs and savings for emergencies.

• How much loss am I prepared to incur?

You must be comfortable with the level of risks that comes with the investment product.

• Do I understand the nature and characteristics of the unit trust fund?

You can get all the information from the Agent and the fund’s prospectus or PHS.

• Do I know all the fees and charges for the unit trust fund?

Different funds may have different charges imposed and may be negotiable.

Important to Note:

Important to Note:

While stories of cheating abound in social media, protecting yourself from scams and fraudsters is easier than you think.

Understanding and managing the risks when making investment decisions is a fundamental component when becoming an investor. All investment instruments carry with them varying degrees

The Securities Industry Dispute Resolution Center (SIDREC) and the Ombudsman for Financial Services (OFS) Malaysia are alternative dispute resolution centres established to assist the public

Securities Industry Dispute Resolution Center (201001025669)

Level 25, Menara Takaful Malaysia

No. 4, Jalan Sultan Sulaiman

50000 Kuala Lumpur

T: +60-3-2276 6969

E: info@sidrec.com.my