‘Dispute Resolution as Part of Your Risk Management Tool Kit’ – see you at Products @ Bursa Workshop 2016

Date: 20 February 2016

Location: St. Giles Wembley Hotel, PENANG

Sidrec gets good response from investors

KUALA LUMPUR: The Securities Industry Dispute Resolution Centre (Sidrec), an alternative dispute resolution approved by the Securities Commission that was set up in January, is already reviewing cases from aggrieved claimants.

“So far, we have two eligible cases that are being processed,” chairman Datuk Ranita Mohd Hussein told StarBiz, adding that Sidrec had been receiving a lot of enquiries from retail investors since starting operations.

“We have received a lot of enquiries but many of them (the claimants) are not eligible because they are already pursuing their claims in the courts.”

Sidrec was established to resolve monetary disputes not more than RM100,000 between retail investors and capital market intermediaries registered as its members, such as stockbrokers, futures brokers, unit trust management companies and fund managers.

The service provided by Sidrec is presently free of charge to claimants.

“If they (the claimants) are in the process of a court action, they’re not encouraged to go to Sidrec. But if they want to withdraw their legal action and come to us, and provided the court approves the withdrawal, we may look into it,” said Ranita.

She said that with Sidrec, retail investors now had more options in settling disputes below RM100,000.

“The small-claim court only caters to civil claims not exceeding RM5,000. Claimants can try pursuing an action in the higher courts but that would incur them costs. Meanwhile, the tribunal for consumer claims only caters to claims not exceeding RM25,000,” she said.

Ranita said many retail investors did not know the next course of action whenever a monetary dispute arose.

“Unless you’re a big player who has access to proper advice, many people don’t really know what’s the best course of action. This is especially the case for small investors, who only think of it when they have a problem.

“At the end of the day, we want a healthy investment atmosphere so that people can make informed decisions,” she said, adding that Sidrec planned to conduct roadshows to create more awareness of the services that it could provide to retail investors.

Sidrec, which is open only to retail investors, seeks to resolve all claims within 90 days of receiving complete documentation and information on the dispute. However, this timeframe might be extended, depending on the complexity of each case, said Ranita.

A person may file a claim with Sidrec either in person or via fax, post or e-mail.

The merits of the claim will be investigated by a mediator who will thereafter attempt to mediate the dispute between the retail investor and capital market intermediary.

Mediation involves both disputing parties voluntarily coming to an agreement to settle the dispute. Where a mediation effort fails, the matter will proceed to adjudication.

If the investor is unhappy with the decision, he is free to reject the decision and pursue the claim through other avenues.

Date: 20 February 2016

Location: St. Giles Wembley Hotel, PENANG

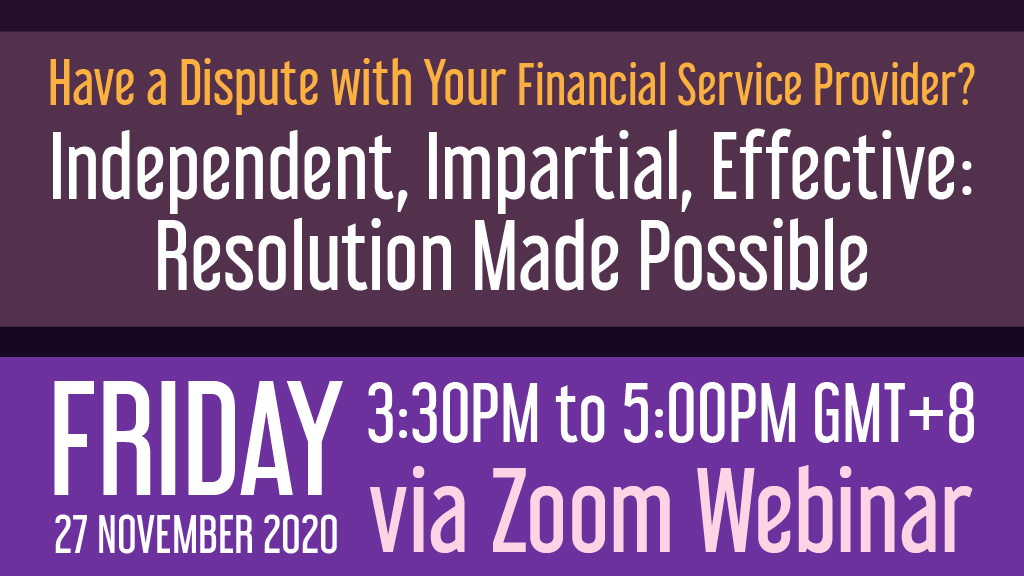

Do you know that you have an alternative when it comes to dispute resolution with your financial service provider?

SIBU: InvestSmart, a comprehensive investment awareness and literacy campaign, is reaching out to people to empower them with the fundamentals of making sound investment decisions.

Securities Industry Dispute Resolution Center (201001025669)

Level 25, Menara Takaful Malaysia

No. 4, Jalan Sultan Sulaiman

50000 Kuala Lumpur

T: +60-3-2276 6969

E: info@sidrec.com.my